It is a distinctive possibility to accessibility far better investments that's not available to most personnel. Not only do you've far more financial commitment selections within just an IRA, but it also will give you increased versatility and more Regulate.

Once your paychecks Give up rolling in, will you be Alright? Run as a result of this pre-retirement checklist to see how All set you really are for life on a fixed money.

In order to stay clear of penalties, waiting around until finally the surrender period of time expires or employing the totally free withdrawal provision, if available, can be practical solutions.

Fifty-nine plus a 50 % would be the magic age when you can begin having revenue out of your respective retirement accounts without having penalty. That doesn’t signify it’s time to drain your accounts, however it does Present you with extra solutions.

This range is not only for present; it empowers you to tailor your investments in your one of a kind economic aims and threat appetite.

Our picks for the best Roth IRAs stick out for his or her very low expenses and large choice of retirement investments.

With this portion, Cash's narration switches towards the past tense, indicating a heightened sense of understanding with your situation he is describing. Particularly, his dwelling on the details of the house from which Anse borrows the spades to bury Addie functions being a minute of foreshadowing.

Employer-sponsored 401(k) programs allow for personnel to add a portion of their income to retirement savings just before IRS tax withholding. Corporations typically match a share of the employee's contribution and increase it to the 401(k) account.

Examining account guideBest checking accountsBest free examining accountsBest on the web check accountsChecking account solutions

The rules may additionally demand you to work at a company for a certain quantity of a long time right before your account gets to be thoroughly vested. With a totally vested account, all contributions from a employer may be accessible for withdrawal.

Make certain that you comprehend the policy prior to deciding to e-indication for your financial loan. Just about every point out has rules and polices in place that payday lenders must stick to when assessing expenses for late payments.

In other circumstances, you owe revenue tax on The cash you withdraw. You can also owe an additional read more penalty in the event you withdraw resources in advance of age 59½. However, after a specific age, you might be required to withdraw some cash yearly and pay taxes on it.

“This is completely THE best Trainer useful resource I've ever procured. My college students really like how organized the handouts are and enjoy monitoring the themes as a category.”

Look at all tax preparing and filingTax credits and deductionsTax formsTax software package and productsTax preparing basicsNerdWallet tax filing

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Kirk Cameron Then & Now!

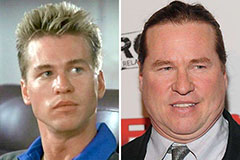

Kirk Cameron Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now!